Union Budget 2023: Voices from the startup industry

[ad_1]

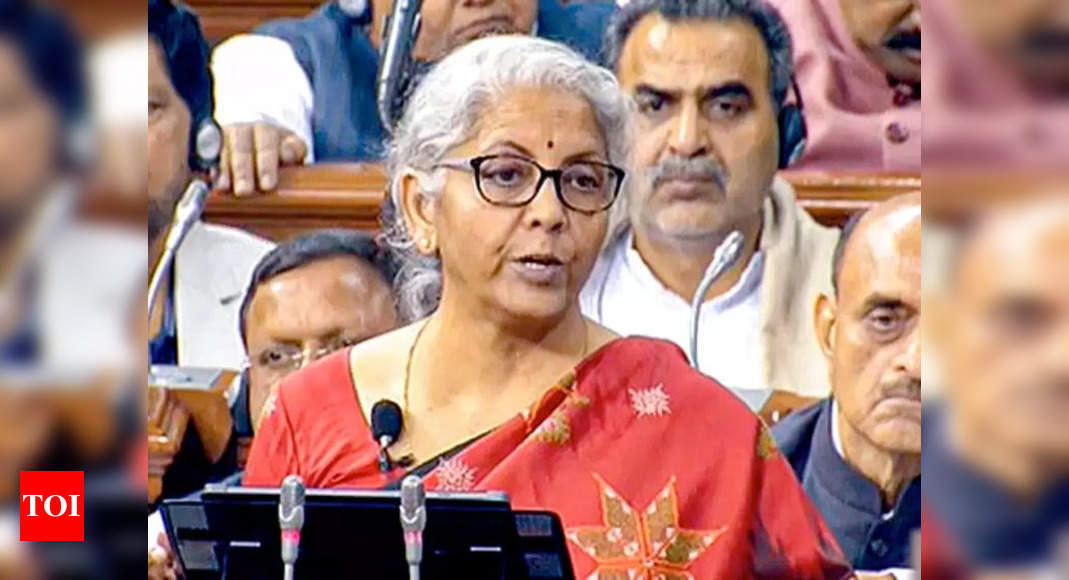

Finance Minister Nirmala Sitharaman announced several measures to boost the satrtup industry in the country. In her budget speech, she proposed the extension of the date of incorporation for income tax benefits to start-ups from March 2024. “Entrepreneurship is vital for a country’s economic development. We have taken a number of measures for start-ups and they have borne results. India is now the third largest ecosystem for start-ups globally, and ranks second in innovation quality among middle-income countries,” said Sitharaman. In the Budget 2022-23, the government had allocated Rs 283.5 crore for the Startup India Seed Fund Scheme, which is higher than the Revised Estimates of about Rs 100 crore in the previous budget. The startup industry has welcomed the budget. Here are what CXOs of some popular startups have to say

Anirban Mukherjee, CEO, PayU India

“Budget 2023 is a great step towards supporting the long-term growth potential of India’s fintech ecosystem amidst increasing global headwinds. The new National Financial Information Registry, simplified KYC processes and adoption of PAN as the common business identifier will help streamline business operations for fintechs across India. The government’s strong focus on cutting-edge tech like AI & 5G will offer a much-needed growth impetus to our country’s digital infra at a grassroots level. We at PayU India welcome the policies laid out in Budget 2023 and are excited to contribute driving financial inclusion through our digital payments & credit businesses.”

Vikas Jain, Co-Founder, PLAY Design Labs

“A very sensible budget presentation and the FM has been considerate to the common man and industry alike. There is massive commitment of job creation and infrastructure spending which is very well received for India. Modification to the income tax slabs is a delight for the citizens and should encourage more citizens to declare their income statement. Most the industry is well taken care of and focus on strengthening manufacturing is evident. We hope to see some focus and action on the “cost of capital” in future budgets and themes. Backing manufacturing by incentivizing R&D/Design could have been a great addition and we remain hopeful for outlay for design in the forthcoming edition.”

Manu Rikhye, Partner, Merak Ventures

“It is a proud achievement for us that India is now the third largest ecosystem for startups globally. As investors, it is encouraging to hear the government is still keen on promoting startups. Entrepreneurship was and always will be vital for boosting the country’s economy. The major announcement on extending the income tax benefit date to start-ups has brought a brief reprieve to the space. To unleash innovation and research by start-ups and academia, a National Data Governance Policy was also brought out to enable access to anonymized data. We hope the government will further look into introducing deferment of the time of payment of tax on ESOP plans available to employees of more startups. It would have also been encouraging if the budget accommodated for an advisory on the PE/VC ecosystem. Easing of restrictions on domestic institutions like Provident Funds and NPS to invest in VC funds would have allowed for greater participation in domestic VC funds, which in turn, will help make patient and long term domestic capital available for AIFs. The carry forward of losses on change of shareholding of start-ups from seven years of incorporation to ten years will amp up investments in the sector. The budget could have been a game changer if the government did not miss the opportunity for rationalization of capital gains, taxation, especially for startups.”

Varun Sridhar, CEO, Paytm Money

“Union Budget 2023 reflects the government’s focus on inclusive growth and digitisation. The stability of reforms will contribute to the India growth story and will positively boost the morale of capital markets. From the simplification of KYC, cap on the maximum tax rate, to increasing the rebate on income tax and strengthening our infrastructural power — there are many welcome moves that will benefit Indians.”

Sanjeev Barnwal, founder and CTO, Meesho

“Making emerging tech mainstream by introducing it in engineering campuses is a masterstroke by our visionary government. The establishment of 5G labs and AI Centres of Excellence conveys a clear focus on boosting research and development, upskilling our workforce and preparing them for a new gamut of opportunities. At the same time, initiatives like the Agriculture Accelerator Fund and a unified Skill India digital platform have potential to deliver meaningful change at the grass roots.”

Ankit Kumar, CEO, Skye Air Mobility

“The budget for 2023 is forward looking and focuses on enhancing talent development and training in digital skills. PMKVY 4.0 will definitely be a boon to bridge the gap especially for the emerging technology sectors where skill manpower is the biggest challenge. The state of the art on job training programmes like coding, artificial intelligence, robotics, mechatronix, 3D printing, internet of things, drones, and other soft skills will surely pave the way for India to lead the world in the technology sector. Alone drone sector in India to witness a demand of 1,00,000 trained drone pilots in next 2 years and we are hopeful that with the launch of PMKVY 4.0 and emphasis on new age skilling and training this will be addressed adequately.”

Anirban Mukherjee, CEO, PayU India

“Budget 2023 is a great step towards supporting the long-term growth potential of India’s fintech ecosystem amidst increasing global headwinds. The new National Financial Information Registry, simplified KYC processes and adoption of PAN as the common business identifier will help streamline business operations for fintechs across India. The government’s strong focus on cutting-edge tech like AI & 5G will offer a much-needed growth impetus to our country’s digital infra at a grassroots level. We at PayU India welcome the policies laid out in Budget 2023 and are excited to contribute driving financial inclusion through our digital payments & credit businesses.”

Vikas Jain, Co-Founder, PLAY Design Labs

“A very sensible budget presentation and the FM has been considerate to the common man and industry alike. There is massive commitment of job creation and infrastructure spending which is very well received for India. Modification to the income tax slabs is a delight for the citizens and should encourage more citizens to declare their income statement. Most the industry is well taken care of and focus on strengthening manufacturing is evident. We hope to see some focus and action on the “cost of capital” in future budgets and themes. Backing manufacturing by incentivizing R&D/Design could have been a great addition and we remain hopeful for outlay for design in the forthcoming edition.”

Manu Rikhye, Partner, Merak Ventures

“It is a proud achievement for us that India is now the third largest ecosystem for startups globally. As investors, it is encouraging to hear the government is still keen on promoting startups. Entrepreneurship was and always will be vital for boosting the country’s economy. The major announcement on extending the income tax benefit date to start-ups has brought a brief reprieve to the space. To unleash innovation and research by start-ups and academia, a National Data Governance Policy was also brought out to enable access to anonymized data. We hope the government will further look into introducing deferment of the time of payment of tax on ESOP plans available to employees of more startups. It would have also been encouraging if the budget accommodated for an advisory on the PE/VC ecosystem. Easing of restrictions on domestic institutions like Provident Funds and NPS to invest in VC funds would have allowed for greater participation in domestic VC funds, which in turn, will help make patient and long term domestic capital available for AIFs. The carry forward of losses on change of shareholding of start-ups from seven years of incorporation to ten years will amp up investments in the sector. The budget could have been a game changer if the government did not miss the opportunity for rationalization of capital gains, taxation, especially for startups.”

Varun Sridhar, CEO, Paytm Money

“Union Budget 2023 reflects the government’s focus on inclusive growth and digitisation. The stability of reforms will contribute to the India growth story and will positively boost the morale of capital markets. From the simplification of KYC, cap on the maximum tax rate, to increasing the rebate on income tax and strengthening our infrastructural power — there are many welcome moves that will benefit Indians.”

Sanjeev Barnwal, founder and CTO, Meesho

“Making emerging tech mainstream by introducing it in engineering campuses is a masterstroke by our visionary government. The establishment of 5G labs and AI Centres of Excellence conveys a clear focus on boosting research and development, upskilling our workforce and preparing them for a new gamut of opportunities. At the same time, initiatives like the Agriculture Accelerator Fund and a unified Skill India digital platform have potential to deliver meaningful change at the grass roots.”

Ankit Kumar, CEO, Skye Air Mobility

“The budget for 2023 is forward looking and focuses on enhancing talent development and training in digital skills. PMKVY 4.0 will definitely be a boon to bridge the gap especially for the emerging technology sectors where skill manpower is the biggest challenge. The state of the art on job training programmes like coding, artificial intelligence, robotics, mechatronix, 3D printing, internet of things, drones, and other soft skills will surely pave the way for India to lead the world in the technology sector. Alone drone sector in India to witness a demand of 1,00,000 trained drone pilots in next 2 years and we are hopeful that with the launch of PMKVY 4.0 and emphasis on new age skilling and training this will be addressed adequately.”

[ad_2]

Source link